The Value Added Tax on second-hand goods

Second-hand goods are movable tangible assets capable of reuse in their current state or after repair. These are items that, having exited their production cycle following a sale or self-delivery made by a producer, have been used and are still in a condition to be reused. Specifically, a second-hand item can be:

– An item purchased in a new condition from a supplier and having undergone usage.

– Or an item manufactured by the company for its own use within its operations (self-delivery).

Please note that:

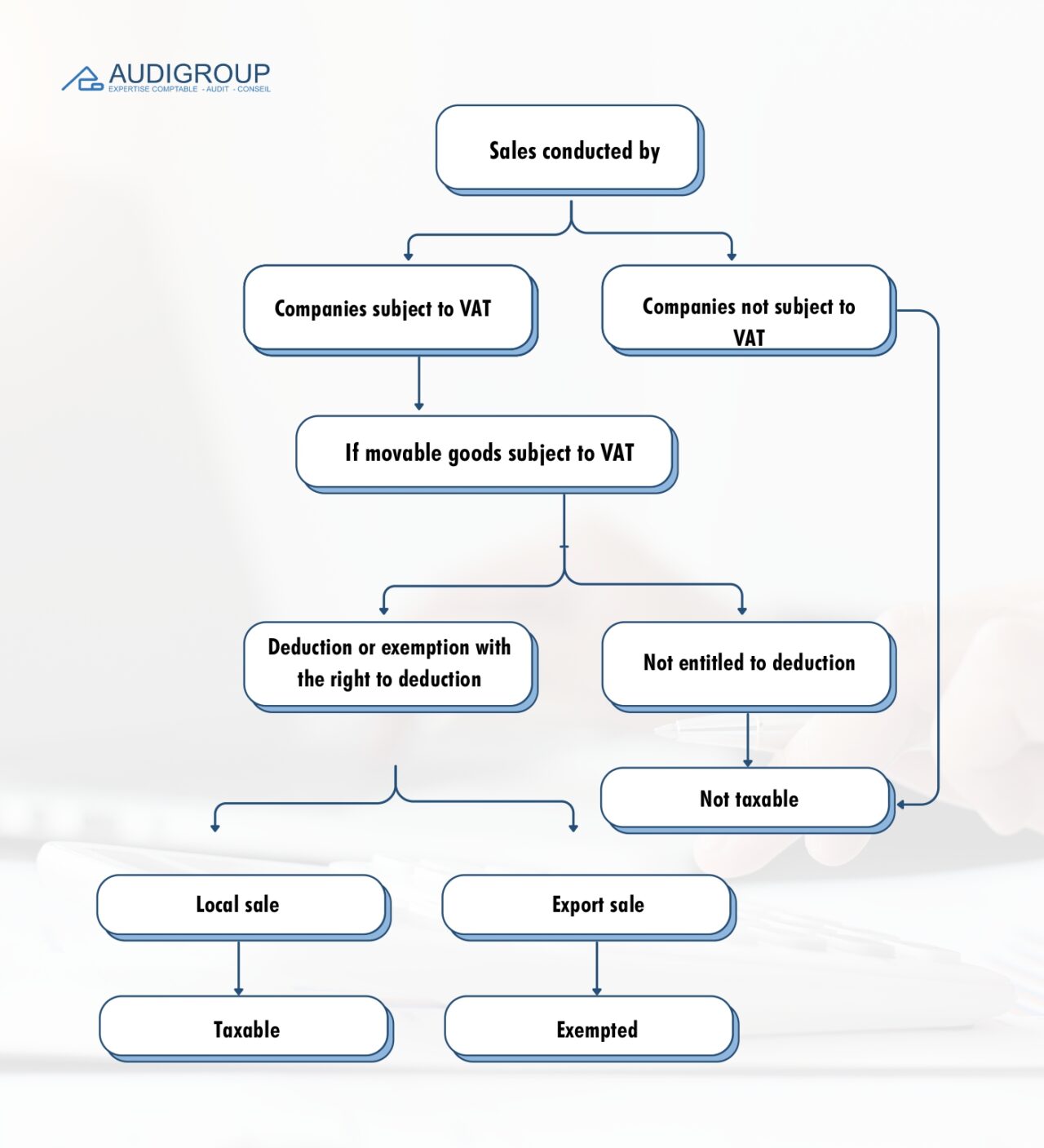

- Companies outside the scope of VAT are considered non-taxable.

- Export sales, depicted in the diagram below, apply to sales of goods made to companies established in Industrial Zones (ZAI).

- If VAT invoicing is requested by a buyer, the company can voluntarily subject the transfer of an item excluded from the right to deduction and with a conservation period of less than 5 years to VAT. In this case, the company can benefit from an additional deduction equal to the amount of VAT.

In conclusion, second-hand goods are items that have exited their production cycle due to a sale or self-delivery by a producer and are still in a reusable state. They can comprise new products that have been used or items manufactured by a company for its internal use. It’s important to note that companies outside the scope of VAT are not taxable. Export sales apply to goods sold to companies established within industrial areas. If VAT invoicing is requested by the buyer, the company can voluntarily subject the transfer of an item excluded from the right to deduction and with a conservation period of less than 5 years to VAT, thus benefiting from an additional deduction equal to the amount of VAT.